Stock Market Mood

Stock Market Mood Stock Market Mood Stock Market Mood |

Predict stock prices by monitoring their social mood

| We analyze your stocks constantly to determine the market mood from news and social media |

|

| What is Stock Market Mood? |

Put simply, Stock Market Mood is a mobile app which allows you to correlate two of the most important aspects of your stock, the current percentage price change and the social mood or sentiment towards the stock at a given time. Presented as a simple two line graph without all the clutter and numeric "fluff" which usually distracts and dazzles. The realtime graph over the past week allows you to monitor and hopefully predict the future trends of your stock prices. Put even more simply if your stock has a high price but low mood value it might be time to sell, conversely a stock with a high mood rating and low price should be a good buy. |

| How do you calculate the mood value? |

Unfortunately giving exact details to any market specific related system will invite being gamed and manipulated by the motivated professional investors. If you monitor only Tweets then be sure every marketeer will start optimizing their tweets for their own particular gain, likewise market "journalists" have been doing the same since the beginning of time. Our server monitors the broadest possible array of social mood indicators to determine the mood value using a complex machine learning algorithm which is constantly improving each day. Beyond the standard market news channels our online bots also monitor Twitter, LinkedIn, Facebook, The United States Patent Office, The legal system, JournalistID and of course major financial corporations. The algorithm is constantly determining the most influential factors but it never looks at the stocks price value! Our primary advantage is we also have unique access to the popular companion app StockMarketStars market simulator game with direct insight into players realtime investing behavior at any particular time. You can actually watch how this mood information helps players beat the real market prices over those who dont use it. On top of this we also have inside access to some of the biggest business markets in the world such as ExportID and ExportBureau. The proof is in the mood graphs themselves and the correlation and predictive nature of that and the price or value. |

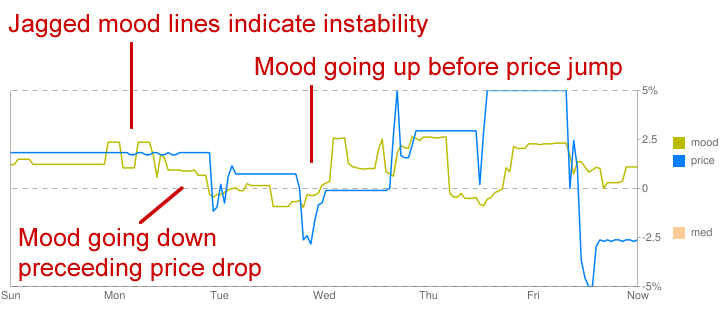

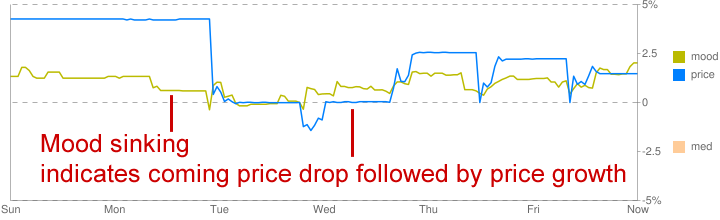

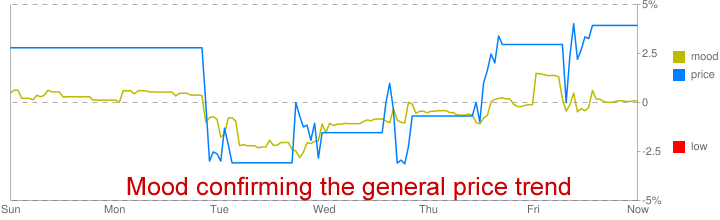

| How to read the mood graphs with examples |

|

|

|

| * Note that the % price change zeros out at the start of every trading day |

| **Take note of the integrity label on the lower right side of every graph. Put simply this is an indicator of how much mood data the server was able to find on a particular company. Vlow means very low and so that should reflect in the integrity of the mood data itself. Less obvious is that Vhigh which is often associated with major companies where there is alot of data and speculation to be found is also not a good indicator as it means there was possibly too much data and so the mood value is less obvious. |

| Tip 1, be aware that different companies have different levels of sensitivity towards the market mood for or against them. |

| Tip 2, rather than focusing on the relative positions of the mood and price lines try to look for patterns of change. |

| What is the cost of your app service? |

| Its entirely free. On top of that we dont ask for any login credentials or your Facebook password so you and your friends wont get spammed to death. Simply install the free android app and add the stocks you wish to monitor, if we dont have existing data on your stock then we will start monitoring it for you. |

| Im a lazy or casual investor and I dont want to watch the mood graph all day |

| Sure I completely understand. Simply create a customized alert on the app settings page which will alert you if the mood or price changes a custom percentage point. |

| I want to test out your mood data risk free |

| Please do, try our system with the free market simulator game StockMarketStars with $10,000 starting money on live stock prices and see how good it is. |

| I have a suggestions on how to improve your results, how do I contact you? |

| Great, this project is open to suggestions, the email is below. |